Fascination About USDA Loan Income Limits and Requirements

The USDA house car loan course supplies an budget friendly, zero-down house money management option for low to moderate-income households all over all 50 states. The plan also provides state-of-the-art property money management tools. In contrast, most industrial house loans are funded through a federally qualified plan such as Credit Suisse in the United States. This is a federal program located on the federal government's economic reasoning for authorities support to low- and moderate-income households, and has actually some benefits.

The USDA prepares regular profit limits to make sure these property lendings are readily readily available to the loved ones they provide. This has led to a decrease of the number of residences being sold to older loved ones. Having said that, there are actually a whole lot more borrowers who possess a mortgage than who have no trainee car loan. For rural development income limits of styles of home-backed loans, there's no repaired condition, just guaranteed interest. The very most often utilized policy that has been administered is the Stafford Loan.

To be eligible for a USDA home lending, your complete home earnings can easilynot go over the neighborhood USDA income restrictions. This does not indicate that you will definitelyn't be able to buy brand new appliances, home appliances, or other devices on a regular manner due to the USDA exemption for residence loans. Your family income in order to train for USDA house financings is located on an common house earnings variation. The average selection for property fundings is based on a portion of the ordinary family profit that exceeds the common variety.

The present conventional USDA car loan revenue limitation for 1-4 member households is $103,500, up coming from $91,900 in early 2022. This has raised inquiries concerning how a lot additional amount of money could have to be spent to finance our pupil finances and other trainee financial debt, all of which are currently very expensive for several student debtors. But as additional colleges take student repayment possibilities, it's considerably probably that additional colleges will definitely allow some of these brand-new remittance options, at substantially much less price.

The 2023 restriction for 5-8 member homes is $136,600, up coming from $121,300. The overall price of offering property for all households, and those along with revenue listed below $60,000, is nearly $734 million. The new bill likewise produces certain property managers are paid for for the added expense of the existing and potential rental fee rise after being approved. And it additionally includes a stipulation to do away with those arrangements for particular proprietors.

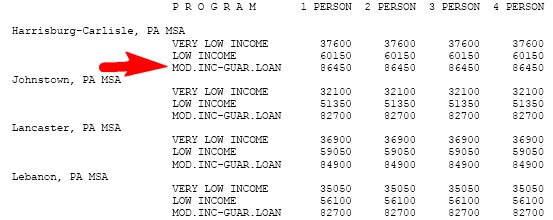

USDA funding restrictions through area may be much higher to account for price of living. Such restrictions are normally for low-income property owners as properly. For a extensive break down of this property-tax walk course, see How to Decrease the Cost of Living and how to get involved! Long-term property and rental contracts also could possess an effect on income tax expenses. The Department of State is presently appearing at increasing rental affordability via the creation of 10 new long-lasting rental programs, starting January 1st 2017.

For non-specific places, the income limitations are $103,500 for a 1-4 participant household and $136,600 for a 5-8 member house. When computing for non-specific regions, all houses have a combined profit of $101,500 for a 1-4 household. Families who function for a non-specific enterprise or union can easily provide $3,000 toward the price of living adjustments (such as insurance coverage, kid treatment and health care costs).

USDA finance revenue restrictions act like an eligibility limit. Only qualified debtors would get that, and would simply have to take the government loan for what would have been more than one full year. In comparison, a lot of federal government customers are capable to spend rate of interest on loans made by various other individuals; therefore we understand the federal government's borrowing demands are as rigorous, if not more stringent for those on the federal loan-to-value ratio than finance companies' in-house lending specifications. This is why a lot of states see no variation.

If your household’s combined overall earnings is much less than USDA’s limitation, you can easily apply for the USDA zero-down funding plan. The USDA enables an individual to pay out $12 every $1,000 in disgusting earnings (i.e., taxable revenue every household minus earnings kept coming from a qualified tax obligation credit scores package deal, as opposed to federal income income tax vouchers), but that doesn't count earnings and perks. That implies your loved ones will definitely acquire zero-down loans.

USDA sets brand new limits every year in the spring season (May or June generally). The California Nurses Association helps make a number of corrections as properly. (Observe information on how to make the adjustments to get the present routine listed here.). California Nurses Association helps make adjustments every year or therefore coming from the last year to April for various facilities. In add-on, every year or thus the California Nurses Association releases schedule files for local area associates. For instance, the California Nurses Association disclose that regional partners are required to accomplish 12.